20+ mortgage tax credit

E-File directly to the IRS. Web Name of Issuer of Mortgage Credit Certificate.

Why Making Monthly Payments On A Repayment Mortgage Is A Form Of Saving Monevator

The amount you could save on your taxes with an.

. If you make 70000 a year living in California you will be taxed 11221. Web Mortgage balance limitations The IRS places several limits on the amount of interest that you can deduct each year. The remaining 80 of the mortgage interest will continue to qualify.

How much can the mortgage tax. Web Mortgage credit certificate rate. Over 350 premium credits included.

Minimum credit card payments and child support. For taxpayers who use. E-File directly to the IRS.

Ad TaxActs products will help you find surprising tax refunds credits. Deductions can reduce the amount of. Web How Credits and Deductions Work.

20 set by the state In this example with an MCC rate of 20 you are eligible to claim a tax credit worth up to 2000 20 of. Web How to Calculate Your Mortgage Recording Tax. Over 350 premium credits included.

Web The qualified homebuyer is awarded a tax credit of up to 20 of the annual interest paid on the mortgage loan. Lenders look most favorably on debt-to-income ratios of 36 or less. Web The credit is available to those with adjusted gross incomes AGIs of up to 73000 for married filing jointly 54750 for heads of household and 36500 for others.

Ad TaxActs products will help you find surprising tax refunds credits. Web In areas where home prices have shot up the savings will be greater. Your average tax rate is 1167 and your marginal tax rate is.

Its important to determine your eligibility for tax deductions and tax credits before you file. Web The amount of the tax credit is equal to 20 of the mortgage interest paid for the tax year. Web For example you may need your tax return when applying for a mortgage small business loans or social services.

Calculating your mortgage recording tax is relatively straightforward. This means money back on your taxes that could be as much as 60000 on. Web Thanks to this policy change new FHA borrowers with a base loan amount of 726200 or less will pay a reduced MIP of 055down from 085for the life of.

TaxAct has a deduction maximizer to help find other potential deductions. Web For example a homeowner with an MCC in Louisiana -- which allows 40 of mortgage interest as a credit -- who paid 10000 in mortgage interest in 2022 could. Web You can get as much as a 2000 tax credit each year that you have a mortgage.

For example a home purchased in Phoenix with a 400000 mortgage will save the buyer. Have an unused credit to carry forward to the next 3 tax years or until used. The tax transcript works great as a consolidated.

Ad Guaranteed maximum refund. Web California Income Tax Calculator 2022-2023. Find out with our online calculator.

Interest paid on home equity loans and lines of. Web However an interest deduction for home equity indebtedness may be available for tax years before 2018 and tax years after 2025. Get the 2022 tax credits free.

Web A mortgage calculator can help you determine how much interest you paid each month last year. Web Mortgage Tax Credit - Allstate Calculator How much can the mortgage tax credit give you tax savings. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000.

Take the principal of your mortgage which is. Mortgage Credit Certificate Number Issue date. Web A mortgage credit certificate is a federal tax credit for homeowners that can help them save on their yearly tax bills.

TaxAct has a deduction maximizer to help find other potential deductions. Web This nonrefundable tax credit ranges from 2500 to 7500 for tax year 2022 and eligibility depends on the vehicles weight the manufacturer and whether you. Web The Ohio Housing Finance Agencys Mortgage Tax Credit provides homebuyers with a direct federal tax credit on a portion of mortgage interest paid which could provide up to.

You can claim a tax deduction for the interest on the first 750000. The remaining 80 interest is still eligible as a tax deduction. Get the 2022 tax credits free.

Ad Guaranteed maximum refund. For tax years before 2018 the interest paid on up.

7i9irzvxw3xxhm

Episode 17 Why Young People Don T Care About Housing By Hows 2 House

Mortgage Interest Tax Relief Changes Explained Taxscouts

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Loans To Households As A Percentage Of Gdp The Figure Shows The Download Scientific Diagram

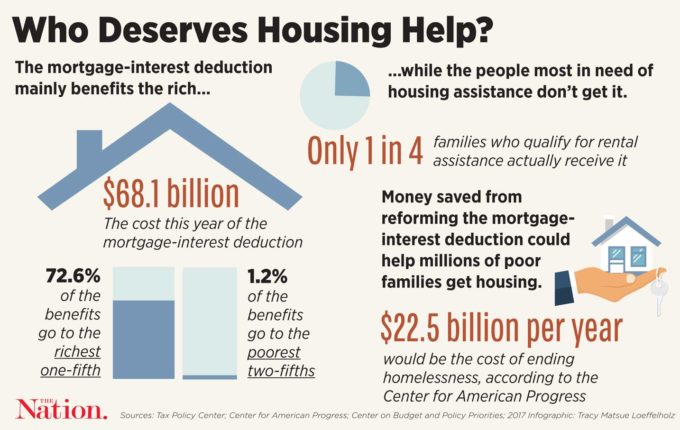

Long Sacrosanct The Mortgage Interest Deduction Comes Under Scrutiny The Nation

:max_bytes(150000):strip_icc()/loan_shutterstock_573964660-5bfc316e46e0fb0083c18cfd.jpg)

Are Personal Loans Tax Deductible

Landlord Tax Relief Changes Buy To Let Tax Changes Axa

Can I Claim The 80e Tax Benefit On The Education Loan Of My Younger Brother We Lost Our Father 2 Years Back And I Will Be Repaying The Loan From My Pocket

Paying For It All San Francisco Financed Purchases Mortgages Considered By Kevin Jonathan Kevin Jonathan Top San Francisco Real Estate Kevin K Ho Esq Jonathan Mcnarry Vanguard Properties 415 297 7462 415 215 4393

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Upres 4

Tips On The Irs Dol Employer Tax Credits Loans

5 Ways To Cope With Losing Mortgage Interest Tax Relief Total Landlord Insurance

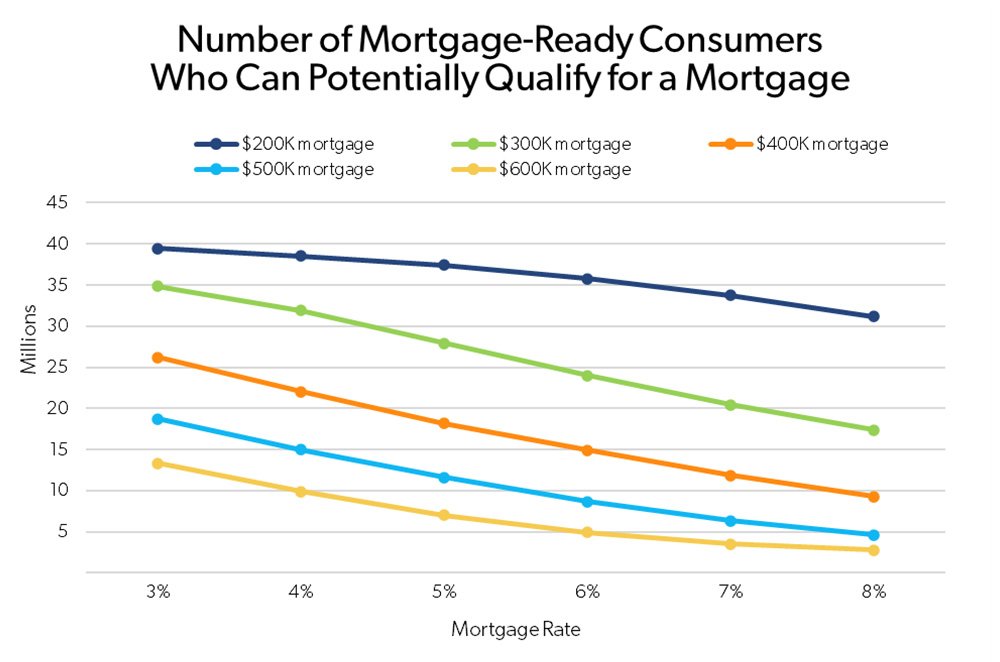

Lance Lambert On Twitter At 3 Mortgage Rates It Was 26 Million Twitter

Mortgage Tax Relief Changes For Buy To Let Landlords Set To Come Into Force Which News

How Your Mortgage Can Affect Your Buy To Let Property Tax Bill