Tax withholding estimator 2022

Our tax system depends on everyone paying. For Tax Year 2022.

How To Calculate Federal Income Tax

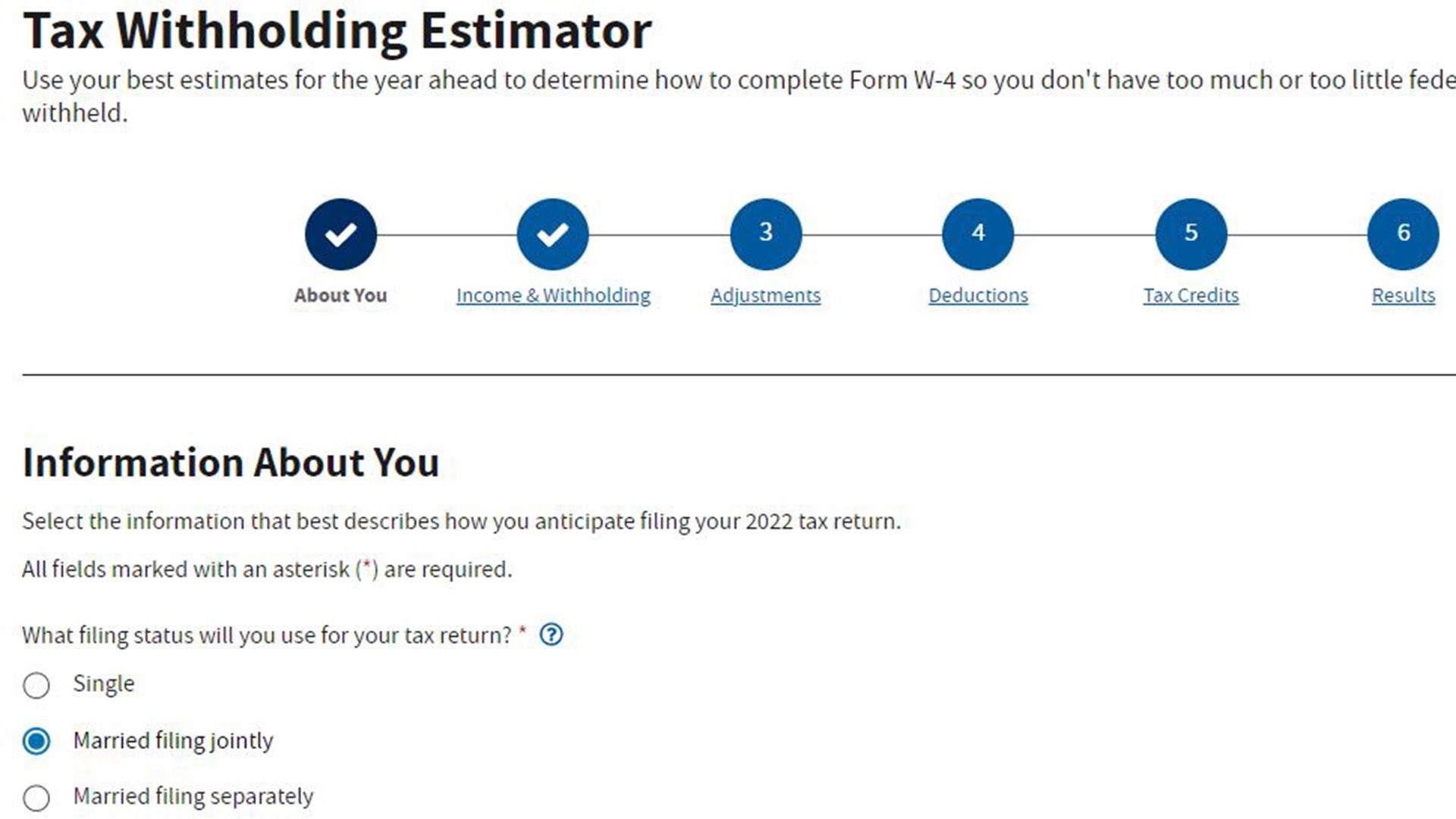

IRS Tax Withholding Estimator helps taxpayers get their federal withholding right.

. Ad Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Once you have a better understanding how your 2022 taxes will work out plan accordingly. Ad Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

Estimate your tax refund with HR Blocks free income tax calculator. Form W-4 PDF Form 1040-ES Estimated. If your employer does not withhold taxes then you.

QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. 2022 income tax withholding tables. Once you have a better understanding how your 2022 taxes will work out plan accordingly.

Between 2021 and 2022 many of the changes brought about by the Tax Cuts and Jobs Act of 2017 remain the same. 2022 Federal Tax Withholding Calculator. Benck failed to report 31300 in income for tax year 2014 131400 for 2015 and 93035 for 2016 causing a tax loss to the IRS of 84092.

This 2022 tax return and refund estimator provides you with detailed tax results. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. Our tax withheld calculators apply to payments made in the 202223 income year.

For Job 1 start with the job for which you want to complete a W-4 form. All taxpayers should review their federal withholding each. The calculator can help estimate Federal State Medicare and Social Security tax withholdings.

This 2022 tax return and refund estimator provides you with detailed tax results. Enter your new tax withholding. This 2022 tax return and refund estimator provides you with detailed tax results during 2022.

Once you have a better understanding how your 2022 taxes will work out plan accordingly. Enter the county in which the employee works. For information about other changes for the 202223 income year refer to Tax tables.

The Tax Withholding Estimator is a free tool on the IRS website that you can use to estimate the amount of tax that should be withheld from your paychecks. States Government English Español中文 한국어РусскийTiếng ViệtKreyòl ayisyen Information Menu Help News Charities Nonprofits Tax Pros Search Toggle search Help Menu Mobile Help. Up to 10 cash back Contributions this year.

Form W-4 Employees Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. For more information see Nonresidents Who Work in Maryland.

Its never been easier to calculate how much you may get back or owe with our tax estimator tool. This calculator is a tool to estimate how much federal income tax will be withheld. This is a projection based on information you provide.

And because the Tax Withholding Estimator isnt for everyone it just works for more people we did include a note on the landing. 2022 Employer Withholding Tax Calculator. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

After all the tool is called the Tax Withholding Estimator. H and R block Skip to. IRS Tax Tip 2022-66 April 28 2022.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. IRS tax forms. Computes federal and state tax withholding for.

W 4 Form What It Is How To Fill It Out Nerdwallet

Tax Debt Help Bear De 19701 Tax Debt Debt Help Payroll Taxes

How To Keep Your 2022 Irs Tax Refund Money Now Rather Than Wait King5 Com

Estimate Your Paycheck Withholdings With Turbotax S Free W 4 Withholding Calculator Simply Enter Your Tax Information And Adjust Y Turbotax Tax Refund Payroll

Calculation Of Federal Employment Taxes Payroll Services

Calculation Of Federal Employment Taxes Payroll Services

Irs Improves Online Tax Withholding Calculator

Book Your Appointment With Affordable Tax Centers Other In 2022 Tax Help Owe Taxes Tax

How To Calculate Federal Income Tax

Adjust Your Withholding To Ensure There S No Surprises On Tax Day Tas

2022 Income Tax Withholding Tables Changes Examples

How To Calculate Federal Income Tax

Irs Finalizes 2022 Federal Tax Withholding Guidance And Forms Ice Miller Llp Insights

Tax Withholding Calculator 2022 Federal Income Tax Zrivo

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Calculating Federal Income Tax Withholding Youtube

Form W 4 Employee S Withholding Certificate 2021 Mbcvirtual In 2022 Changing Jobs Federal Income Tax Internal Revenue Service