All taxes taken out of paycheck

Income amounts up to 9950 singles 19900 married couples filing. Complete a new Form W-4P Withholding Certificate for Pension or.

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Also What is the percentage of federal taxes taken out of a paycheck 2021.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

. Ad Get the Paycheck Tools your competitors are already using - Start Now. The new W-4 removes the option to claim allowances as it instead focuses on a five-step process that lets filers enter personal information claim dependents or indicate any additional income. Depending on your state and local.

Complete a new Form W-4 Employees Withholding Allowance Certificate and submit it to your employer. By placing a 0 on line 5 you are indicating that you want the most amount of tax taken out of your pay each pay period. In the United States the Social Security tax rate is 62 on.

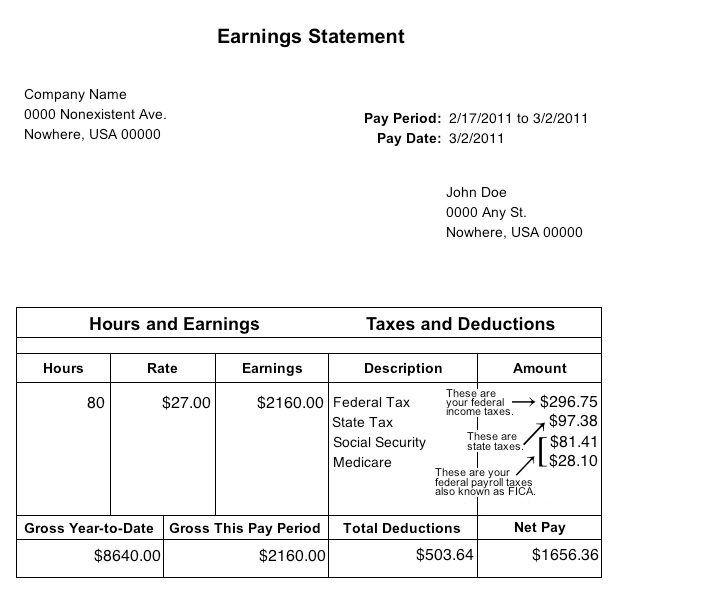

You pay 62 of your salary up to the Social Security wage cap which is 142800 for 2021 and 145 in taxes. To be exempt you must meet both of the following. Social Security and Medicare withholding are also known as FICA.

Add the taxes assessed to determine the total amount of tax to withhold from an employees check. Most people working for a US. Employer have federal income taxes withheld from their paychecks but some people are exempt.

Income taxes are due as you earn income. A withholding tax takes a set amount of money out of an employees paycheck and pays it to the government. Federal Insurance Contributions Act FICA Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social.

There are two types of payroll taxes deducted from an employees paycheck. Social Security and Medicare. If you wish to claim 1 for yourself instead then less tax.

To make the accounting easier if you are not subject to withholding the law allows estimated quarterly payments instead of daily or weekly. How do you calculate taxes taken from your paycheck. Thats because the IRS imposes a 124 Social Security tax and a 29 Medicare tax on net earnings.

Federal law says your employer must take federal income tax and FICA taxes out of your paychecks unless youre excluded from withholding. Discover The Answers You Need Here. These are the federal tax brackets for the taxes youll file in 2022 on the money you made in 2021.

The money taken is a credit against the employees annual income. Divide the result by. Choose Your Paycheck Tools from the Premier Resource for Businesses.

Calculate Taxes On Paycheck Top Sellers 53 Off Www Wtashows Com

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Paycheck Calculator Online For Per Pay Period Create W 4

Check Your Paycheck News Congressman Daniel Webster

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Paycheck Taxes Federal State Local Withholding H R Block

Taxes On Paycheck Store 54 Off Www Ingeniovirtual Com

Tax Information Career Training Usa Interexchange

Taxes On Paycheck Store 54 Off Www Ingeniovirtual Com

Understanding Your Paycheck

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

Understanding Your W 2 Controller S Office

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

What Are Payroll Deductions Article

Understanding Your Paycheck Credit Com

Anatomy Of A Paycheck Video Paycheck Khan Academy